U.S. Tariffs on Bangladesh Garments Part of Expanding Trade War Affecting Global Supply Chains

Dhaka, July 2025 — Bangladesh is facing one of its most serious trade challenges in recent memory, as newly imposed U.S. tariffs threaten to significantly disrupt its largest export sector—the readymade garment (RMG) industry. Under a sweeping trade policy shift announced by the U.S. government, a 35% tariff will be applied to Bangladeshi garment exports starting August 1, 2025. This is part of a broader escalation in the ongoing U.S.–China tariff war, which now extends to 14 countries, including Bangladesh.

The move comes under the revived “America First” policy introduced by former President Donald Trump, who has re-emphasized protectionism as a core element of U.S. trade strategy. While the primary target remains China, the policy has cast a much wider net—sweeping in countries like Bangladesh, Vietnam, and South Korea that rely heavily on export-driven economies.

For Bangladesh, the impact could be devastating. The RMG sector contributes over 80% of the country’s total export earnings and employs more than 4 million workers, most of whom are women from low-income households. This industry has been the backbone of Bangladesh’s economic growth for decades, helping the country move from a least developed country (LDC) status to a lower-middle-income nation.

Now, that progress is under serious threat.

A Sudden Blow to a Critical Industry

The sudden imposition of a 35% tariff marks a more than threefold increase from the previous U.S. rate of 10%. Many industry insiders were caught off guard. According to sources in the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), several U.S.-based clients have already begun cancelling or postponing orders in anticipation of higher costs.

“We’re seeing a chilling effect already,” said one Dhaka-based exporter. “Buyers are holding back, and it’s causing panic in the supply chain. If this continues, we could see thousands of jobs lost by the end of the year.”

Some U.S. importers have reportedly shifted new orders to Vietnam and India, where diplomatic engagements with the U.S. have led to better trade concessions. India, in particular, has emerged as a major beneficiary, with its textile exports already seeing an 8% bump following the announcement of U.S. tariffs on Bangladeshi goods.

Bangladesh’s Lagging Diplomacy

Critics within Bangladesh are blaming weak diplomatic outreach and delayed policy responses for the country’s current predicament. While Vietnam, Indonesia, and others managed to negotiate more favorable tariff terms through early bilateral talks, Dhaka failed to submit its formal tariff concession documents on time.

“Unfortunately, we have not been proactive,” said one trade policy analyst. “We should have anticipated this move and engaged with the U.S. Trade Representative (USTR) office much earlier. Now we’re playing catch-up.”

Commerce Secretary Mahbubur Rahman confirmed that Bangladesh is now in urgent talks with the U.S. government to reduce the tariff level or seek a grace period. Officials are hoping to negotiate the rate down to around 20%, but with just weeks left before the tariff goes into effect, time is running out.

Economic Risks Ahead

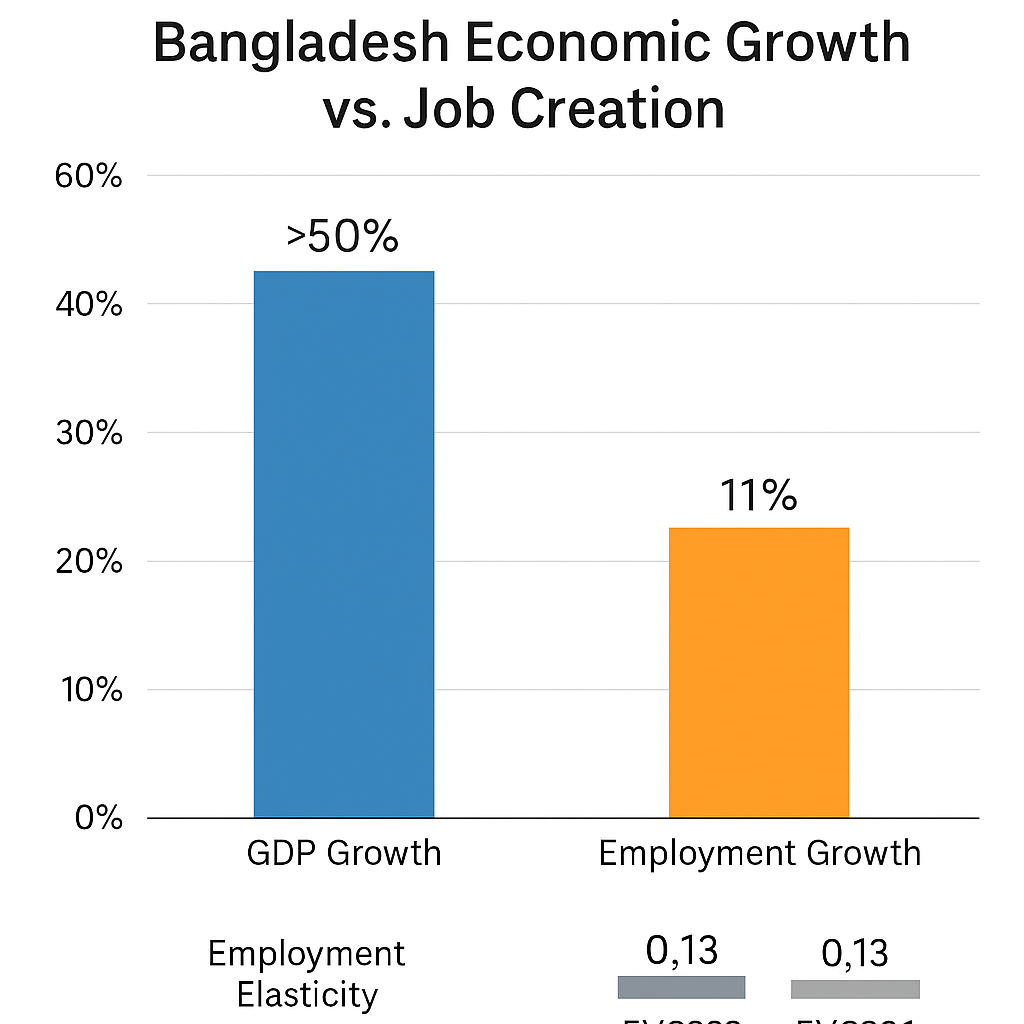

Economists are warning that the new tariff could push Bangladesh’s garment export industry into contraction. If the full 35% rate is applied—plus U.S. state-level duties and handling costs—the effective tariff on some goods could exceed 50%. That would make Bangladeshi garments uncompetitive in the world’s largest consumer market.

“If U.S. buyers lose price advantage, they’ll go elsewhere,” said an international trade consultant based in Washington, D.C. “The apparel industry is fast-moving, and delays or added costs can quickly change buyer decisions.”

This could have ripple effects throughout the economy. The loss of garment export revenue would likely cause a reduction in GDP growth, weaken the Bangladeshi Taka, and disrupt employment across associated sectors including textiles, transport, logistics, and port services.

A Call for Diversification

The crisis has renewed calls for Bangladesh to diversify its export portfolio beyond garments. While sectors such as leather goods, pharmaceuticals, IT services, and jute have shown promise, they remain underdeveloped. Experts argue that Bangladesh must move quickly to expand these sectors to reduce dependence on a single export category.

“We’ve been too comfortable relying on RMG,” said one economist at the Centre for Policy Dialogue (CPD). “This is a wake-up call. We need to build competitive industries across other sectors and secure broader trade deals that protect us from this kind of vulnerability.”

Some have suggested accelerating talks with the European Union, ASEAN, and Middle Eastern markets to reduce reliance on Western buyers.

Seeking Relief

For now, Dhaka is focused on urgent negotiations. Bangladesh is pushing the U.S. for a grace period of six months, during which the new tariff would not be enforced or would apply at a reduced rate. Officials hope that this period could be used to restructure trade terms or secure targeted exemptions for critical product lines.

BGMEA, meanwhile, has called for direct involvement from the Prime Minister’s Office and the Ministry of Foreign Affairs to intervene at the highest diplomatic level. Industry leaders argue that the government must treat this situation as an economic emergency.

Conclusion

As the August 1 deadline approaches, the future of Bangladesh’s key export sector hangs in the balance. The U.S. tariff hike, though part of a broader geopolitical conflict, has created a high-stakes challenge for a country that relies on international trade for jobs, growth, and stability. Without quick diplomatic success or immediate economic mitigation, Bangladesh could be facing a sharp downturn—one that might take years to recover from.

source : thedailystar